Avianca is a Colombia based Star Alliance airline service. It is the third biggest airline service in South America. Avianca offers the most unique airline reliability schedules called Lifemiles. In previous days this program offers hours of entertainments to the Avianca members. Now those days have over.

Avianca offers credit card services also. As a credit card member Avianca Lifemiles helps you to live a rich life and offers you more way to earn miles faster so that you can maximize your life.

Why to Choose Avianca Lifemiles Credit Card:

If you are thinking to apply for a credit card then you can select the Avianca LifeMiles Credit Card for the below reasons:

- Receive points or miles on every purchase.

- Double points for groceries and gas.

- Points don’t expire.

- Insurance on travel accident.

- Emergency card replacement facility.

- Zero liability.

- Unwanted charge protection.

Eligibility Criteria For The Avianca Lifemiles Credit Card:

If you are interested in earning some extra mile then Avianca LifeMiles Credit Card is the best option for you. To hold a credit of Avianca LifeMiles you should meet the below eligibility criteria.

- Your age should be 18 years or more than 18 years.

- You should be an Avianca LifeMiles to apply for the credit card.

- You should have a permanent and valid mobile number to inform about any suspicious activity or, to give a reminder about the late payment charges.

- Post validation of your details the allocation of a credit card depends on Avianca’s approval.

BenefitsOf Avianca Lifemiles Credit Card:

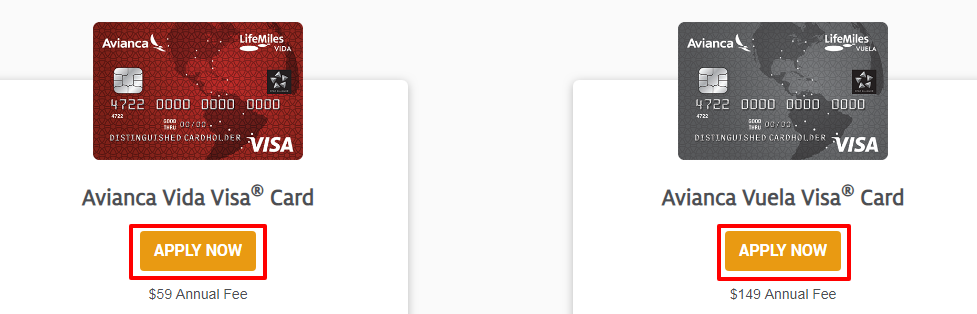

Avianca LifeMiles Credit Card provides two types of credit cards and the benefits of these cards are:

- Avianca Vida Visa Card:

- 20,000 bonus life miles after first card use.

- Earn 2 LifeMiles per $1 spent on Avianca purchases.

- Earn 1 LifeMiles per $1 spent on all other purchases.

- 15% discount of miles with multiply your miles.

- Avianca Vuela Visa Card:

- 40,000 Bonus LifeMiles after first card use.

- Earn 3 LifeMiles per $1 spent on Avianca purchases.

- Earn 2 LifeMiles per $1 spent on gas stations and grocery stores.

- Earn 1 LifeMiles per $1 spent on all other purchases.

- No foreign transaction fees, which is very useful for regular travellers.

- 15% discount on purchases of Miles with multiply your miles.

- An extra piece of luggage for travellers between Central America and the United States

Charges Of Avianca Credit Cards:

- Avianca Vida Visa Card has annual fees of $59.

- Avianca Vida Visa Card Avianca Vida Visa Card has annual fees of $149.

How To Apply For Avianca Credit Cards:

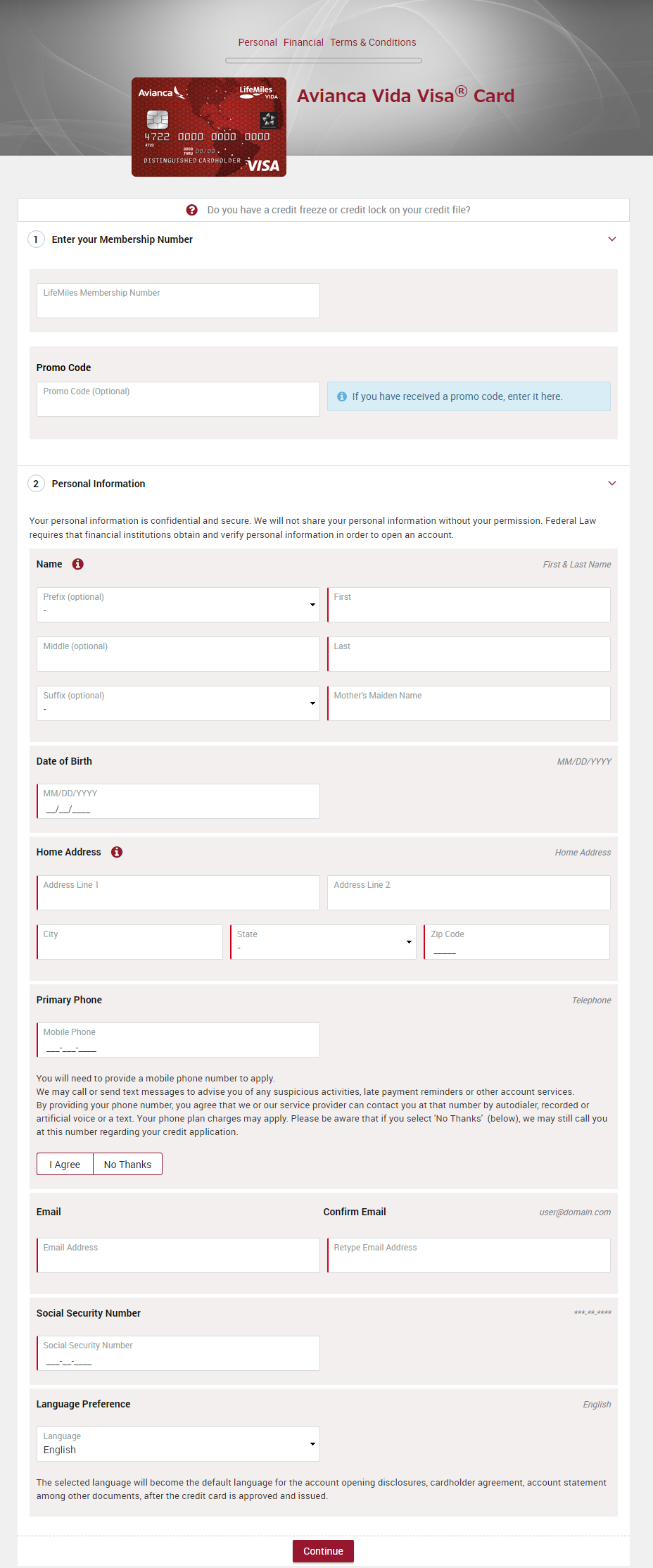

To apply for the Avianca Credit Card you need to follow the below process:

- Open the official website with the link www.lifemilescreditcard.com

- Click on the “Apply now” option of the Avianca Vida Visa Card or Avianca Vida Visa Card section for which you want to apply.

- Enter your Avianca membership number.

- Enter all the details requested on the page and click on the Continue option.

Read Also. Apply for Academy Sports + Outdoors Visa Credit Card

Overview:

- Avianca is a ColombianAirline Company.

- Founded on 5 December 1919 as SCADTA.

- Avianca is the world’s second oldest airline after KLM.

Reference: