SunTrust bank holding is an American concern and it is the largest subsidiary of the Suntrust Bank. The bank was founded in 1891 and the bank holding has its headquarter in Atlanta, Georgia, United States. The company also has its subsidiaries named, SunTrust Robinson Humphrey and so on.

If you are worried about managing the business payroll, then, you can go for the SunTrust Small Business Payroll services. Their services are offered just for small businesses. This service will help you manage payroll with comfort, it will also reduce your company’s labor and cost.

Enrollment For SunTrust Online Payroll

For this to make into reality, you have to enroll for the SunTrust Online Payroll services on their website. The enrollment process only takes a few minutes, and then you can get access to this system using your personal computer from anywhere. For the enrollment, you need to have a Federal Employer Identification Number. If you don’t have this specific number, then, you have to visit the IRS where you will require to request the FEIN number. You also have to have the bank account details of your business and with the state identification number.

The required information

- It will require the personal information, which is, your name, SSN, address, and the email address

- The pay info and it will include, status type, hire date, pay rates

- and deductions.

- The allowances and withholding status of the W-4 forms of all the employees

- The bank’s direct deposit information

- For the completion of the enrollment process, you have to provide the proof of state ID or FEIN numbers.

Selection of the Business Type

Every industry has specific types of earnings or tax filing requirements. To make sure of the accuracy in the tax filing, you have to select the right type of business from their list. The available business types are Household Employer, Officer Only, Church, No-Profit Organization, General Business, and Restaurant.

Note

If you want the Non-Profit setups or Church, you have to provide the federal or state documentation in and this for to support the request for a status of the exemption of the tax.

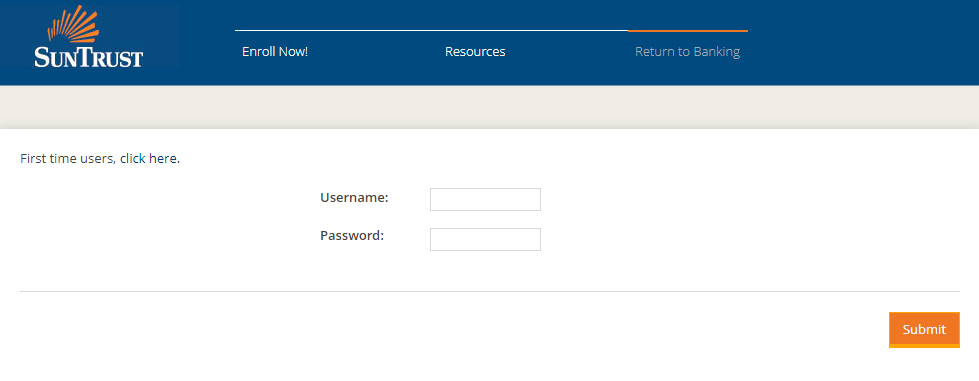

Login for the SunTrust payroll system

For this, you have to visit, www.suntrust.com/mypaycheck

Here, you have to type the,

- Username

- The confirmed password

- Then, at the right side click on, ‘Submit’.

Enroll for the account

For this, at the top left side click on, ‘Enroll’.

Here, you have to scroll down and choose your business type.

Then from the right bottom side, press on, ‘Next’.

On the next page, you have to type,

- Company Name

- Username

- Password

- Confirm Password

- First Name

- Last Name

- Email Address

- Phone Number

- Then at the right bottom side, click on, ‘Continue’.

Note: From the resources, which you can find at the right side of the ‘Enroll button, you will get to download all the forms you require for this service. If you have any queries for the forms, then you can send a fax, 1-847-676-5150.

You can send a mail to, Sales Department, 2350 Ravine Way, Glenview, IL 60025. Or you can choose to call at, 877.432.1824, from 8 a.m. to 9 p.m. Monday to Friday.

Read Also. Manage Vanilla Visa Gift Card Online

SunTrust payroll Contact details

If you want to contact the SunTrust, you need to call on, 877.432.1812. You can send a fax: 1-847-676-5150. Or you can send a mail to, Sales Department, 2350 Ravine Way, Glenview, IL 60025.

Reference :