About ABOC Platinum Rewards Card Review:

About ABOC

The Amalgamated Bank of Chicago or in short ABOC is a commercial bank, based in the United States. Headquarter of this bank is located in Chicago, Illinois, United States. IT was first started in 1922. They also provide their banking services in Warrenville, Illinois. ABOC bank also offers several credit cards to its customers. If you have an average credit score or better, you should consider applying for the ABOC credit card.

ABOC Platinum Credit Card Review:

You will get several credit cards in the market. But for the average credit score, you are not getting qualified for every credit card. People with average to good credit score, the ABOC Platinum Rewards Card is a good option. For this card, it is very easy to get approved for. But in case, your FICO score is below 630, they have to go with the secured credit card. For people with excellent credit, there are better options available in the market.

This credit card is a no annual fee credit card. So, there is nothing worry about the annula fees. On your every purchase using this card, you will get 1% back. Along with this, there is a $150 sign up bonus. You will also get the benefit of 0% intro APR for 12 months of your account opening. For this type of credit cards, the 0% intro APR and $150 statement credit is a great deal.

How to Apply for the ABOC Platinum Credit Card:

It is very easy to apply for the ABOC Platinum Credit Card. You just need to follow some of the basic instructions to complete the application process. You can simply follow these instructions as mentioned below to complete the application process:

- First, you have to visit this link www.platinumrewardsnow.com.

- Then, you need to click on the Apply Now option.

- Then, you have to provide your name, address, email, and phone numbers on the given fields.

- Agree with the terms and conditions and click on the Continue button.

- After that, you need to follow the on-screen details to complete the application process.

Rates and Fees of ABOC Platinum Credit Card:

Rates:

- APR for Purchases: For the first 12 months, your intro APR will be 0%. After the 12 months, it will be 12.90% to 22.90%.

- APR for Balance Transfers: Based on your creditworthiness, your APR for the balance transfer will be 12.90% to 22.90%.

- APR for Cash Advance: For the cash advance, your APR will be 24.99%.

Fees:

- Annual Fee: There are no annual fees for the ABOC Platinum Rewards Credit Card.

- Cash Advance Fee: For each cash advance, you will be charged 5% of the amount or at least $10.

- Balance Transfer Fee: For each balance transfer, you will be charged 3% of the amount or at least $5.

- Late Payment Fee: For the late payment fees, you will be charged up to $35.

Pros and Cons of ABOC Platinum Credit Card:

Pros:

- With the ABOC Platinum Credit Card, you can earn 5% cashback on the eligible spending categories. The categories rotate, typically include the purchases made at grocery stores, gas stations, and online retailers.

Cons:

- You can earn up to 5% cashback on selected purchases. But there is a quarterly spending limit of $1,500 for such rewards. After the spending limit, further purchases will earn only the 1% rate that applies to all other spendings.

- You can’t expect additional features with the no-fee credit cards. But the ABOC Platinum Rewards has many competitors in the market. It gives the customer security protections along with the extended warranty.

How to Pay ABOC Platinum Rewards Card Bill:

There are several ways to pay your ABOC Platinum Rewards Card bill. You can simply follow these instructions below:

Online Method:

The online method is quite simple. You just need to follow some of the basic instructions to complete the payment. To make the payment, you need to follow these instructions below:

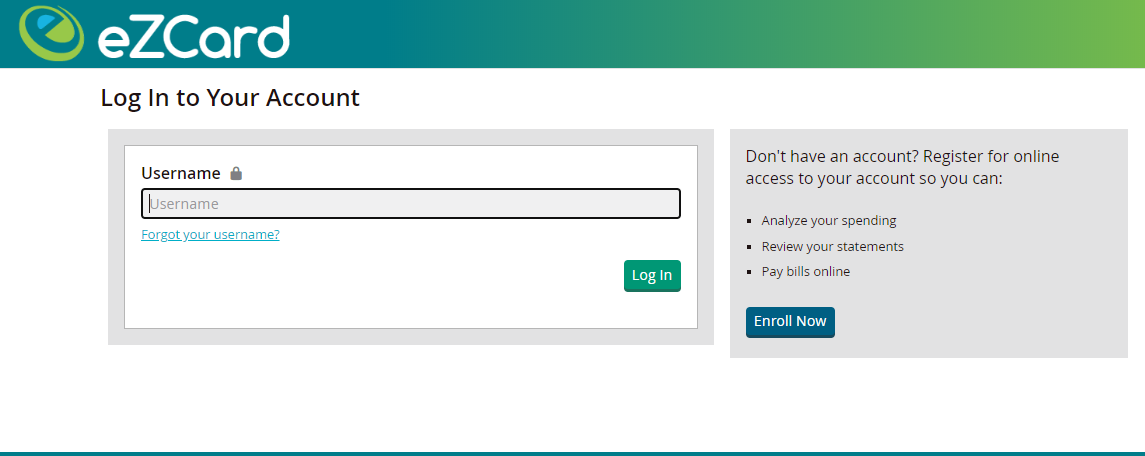

- First, you have to visit this link ezcardinfo.com.

- Then, simply enter the username on the given field.

- After that, simply click on the login button.

- After that, follow the further steps to complete the process.

Pay by Mail:

You can pay your credit card bill through the mail. Before sending the mail, make sure to enter your full name and full account number on your check and send it to this address below:

Amalgamated Bank of Chicago

P.O. Box 1106

Chicago, IL 60690-1106

ABOC Contact Info:

If you need contact with the ABOC customer service, then contact them at:

Mail:

30 N. LaSalle, Chicago, Il 60602

312-822-3000

28600 Bella Vista Parkway, Warrenville, IL 60555

630-225-4300

Email: customerservice@aboc.com

Conclusion:

So, if you have the average credit score range of 630 to 700, then you should go for the ABOC Platinum Rewards Card. If you want to apply for the ABOC Platinum Rewards Card, you need to follow these instructions as mentioned above.

Reference Link: