How to Login at Citi Bank Online Account:

About Citi Bank

Citi Bank is the part of the multinational Citi group. In 1812, Citi Bank was first started as the City Bank of New York. Citi Bank has more than 2,649 branches within the 19 countries. They provide their customers the credit cards, personal loans, mortgages, lines of credit, etc. People know Citi Bank for its wide range of credit cards. Citi Credit Cards allows its users to do a lot more than just swiping and buying things. With the Citi Card, you will receive rewards in almost everything, be it the dining, shipping, movies, and much more.

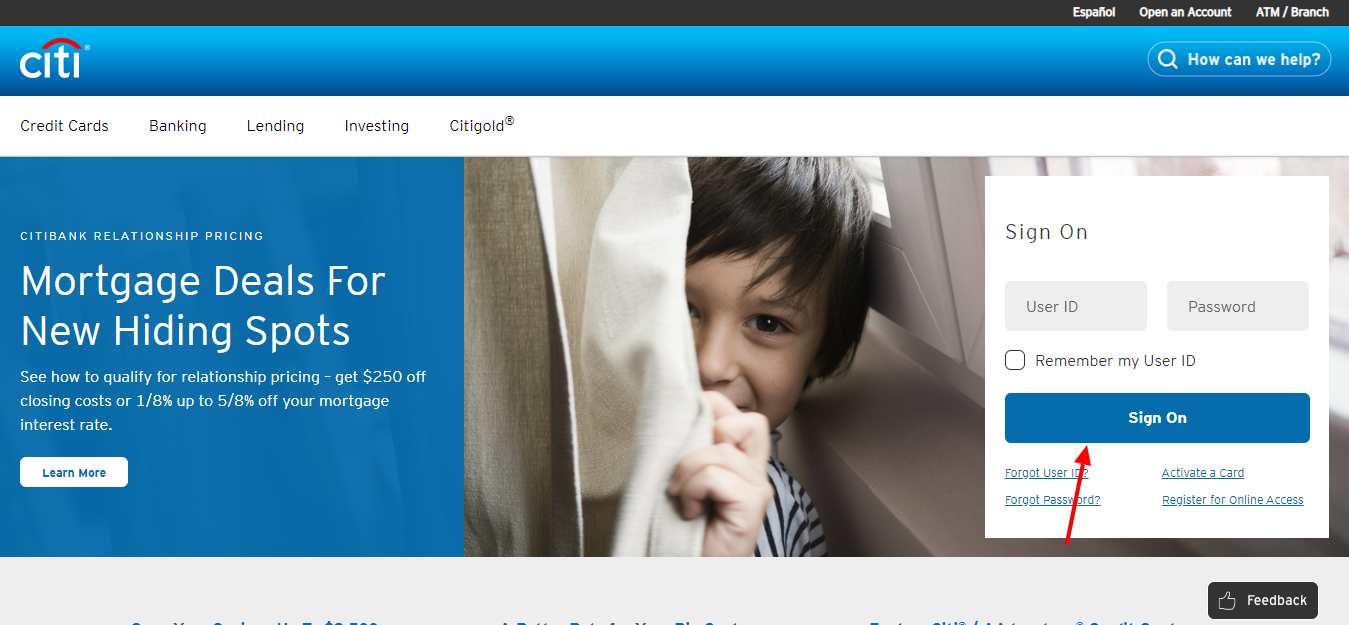

How to Login at Citi Bank Online Account:

The login procedure for the Citi Bank online account is quite simple. You will require your username and password to access your Citi Bank account. If you have these login credentials, then you need to follow these instructions below to login to your account:

- First, you have to visit the official website of the Citi Bank.

- Or, you can simply click on this link online.citi.com, for the direct access to the website.

- There, on the homepage, you will see the login section.

- There, simply enter your username and password on the provided fields.

- If you are using your personal device, then check the box, Remember My User ID option.

- After that, simply click on the Sign-On button.

How to Register for the Citi Bank Online Banking:

If you haven’t yet registered for the Citi Bank Online Banking, you need to register online. The registration process is very simple. You will require a few of your personal devices to complete the registration process. You need to follow these instructions below to register your Citi Bank Online Banking account:

- First, you have to visit the official website of the Citi Bank.

- By clicking on this link online.citi.com, you will be redirected to the website.

- There, you will find the login section on the right side of the page.

- You have to click on the Register Your Online Account option.

- You can register using, your credit/debit card or bank account number.

- After providing the detail, you need to click on the Continue Set-Up option.

- Then, you need to follow the on-screen prompts to complete the registration process.

How to Reset User ID:

In case, you forgot your user ID, then you need to follow these instructions below to reset the user ID:

- First, you have to visit the official website of the Citi Bank.

- You can simply click on this link online.citi.com, for the direct access to the website.

- There, on the right side, you will get the login section.

- You have to click on the Forgot User ID option.

- If you are a Bank or Credit Card Customer, then select the option and provide your card details.

- After that, simply click on the Continue button to recover your forgotten User ID.

How to Reset the Password:

The password is a very important credential to access your account. If you forgot your password, then you need to reset the password. You can easily reset your password, just by following these instructions below:

- First, you have to visit the Citi Bank website by clicking on this link online.citi.com.

- There, you will get the login section on the right side of the homepage.

- Click on the Forgot Password option, under the Sign-On button.

- If you are a Bank or Credit Card users, then choose the option, and provide the details.

- After that, simply click on the Continue button for further steps.

Also Read : Apply for easy Personal Loan from Best Egg

Some of the Credit Cards Offered by Citi Bank:

Citi Bank offers a wide range of credit cards. Here are some of the credit cards offered by the Citi Bank:

Citi Rewards Plus Card:

With this card, you can earn bonus points on spending $1,000 in purchase within the first 3 months.

Rates and Fees:

- For the first 15 months of your account opening, your introductory APR on purchases and balance transfer will be 0%. After the first 15 months, your variable APR will be 13.49% to 23.49%, depends on the creditworthiness.

- For the balance transfer, you will be charged either 3% of the amount of $5 minimum.

- For this Citi Credit Card, you don’t have to pay any annual fees.

Citi Double Cash Card:

This is one of the best Citi Credit Card, through which you can earn cashback twice. On purchases, you will get to earn 2% with 1% cashback when you buy. Along with this benefit, you will get an additional 1% cashback.

Rates and Fees:

- There will be no intro APR for balance transfer for the first 18 months. After that 18 months, your intro APR will be 13.99% to 23.99%, depends on the creditworthiness.

- For the balance transfer, you will be charged 3% of the amount each time or $5 minimum.

- There are no annual fees for Citi Double Cash Card.

Citi Simplicity Card:

The best thing about this card is, it does not charge any late payment fees, no penalty fees, and no annual fees.

Rates and Fees:

- First 18 months of your account opening, your intro APR on the purchase will be 0%. After that, it will vary from 14.74% to 24.74$, depends on the creditworthiness.

- For the balance transfer, you have to pay 3% of the amount you transfer each time or $5 minimum.

- Annual Fee: There will no annual fee for this Citi Credit Card.

Citi Customer Service:

Consumer: 1-800-347-4934

Customer TTY: 1-800-325-2865

Business: 1-866-422-3091

Lost/Stolen: 1-800-950-5114

Conclusion:

So, it is very easy to log in to your Citi Bank Online account. After login to your account, you easily manage your Citi Credit Card and pay your credit card bill. You may face a few difficulties for the first time. So, you can simply follow the above-mentioned instructions to complete the login process.

Reference Link: