The Luma Credit Card is endorsed & issued by the Capital One (Europe) Public Limited Company, which is enrolled in the United Kingdom. It is pretty simple to make an application for the Luma Credit Card and customers can get a response within a couple of moments. Customers can get a credit limit point of up to £1,500 using the Luma Credit Card.

A large section of people uses the Luma Card reliably to make payments for their regular household products alongside amusement like dining out, making advances for a car, a holiday tour, etc. The main purpose behind why so many people utilize the Luma Cards is that it is easy to carry around and it’s digitally safe, to make your payments in critical situations and nowadays most places acknowledge the Luma Cards for their simplest utilization.

Benefits & Advantages of Luma Credit Card

- Eligibility Requirements – You can avail of a credit card even if you are new to the credit world.

- Manage your Account Online – You can easily access your account Online & using and Luma Mobile Application, anywhere, & anytime.

- Add Additional Cardholders – Manage your regular household’s finances and track your overall expenditure. And please keep in mind, that you are solely liable for all transactions on your account.

- Simple to Manage – Avail of a Credit limit of up to £1500 using the card.

- No Hidden Surprises – There are No Annual fees, & No Hidden Charges.

- Get free identity theft protection & Automated fraud alerts – Luma always ensures that your account stays digitally safe & you get support when you required it most.

Rates and Interests

- Representative APR – 35.9% (Variable)

- Monthly Purchase Rate – 2.59%

- Annual Monthly Rate – 35.94%

- Monthly Cash Withdrawal Rate – 2.59%

- Annual Cash Withdrawal Rate – 35.94%

- Monthly Balance & Money Transfers – 2.59%

- Annual Balance & Money Transfers – 35.94%

- Interest-free Period for Purchase – A period of a maximum of 56 days is permitted for purchase, in case the balance payment is made in full within the due date.

- Interest-free Period for Balance / Cash & Money Transfers – Zero (0) days

- Credit Limit – Minimum £200 to £1,500 Maximum

- Handling Fees for Balance & Money Transfer – 3.0%

- Cash Fee (Including Gambling Transactions) – 3.0% (Minimum £3)

- Non – Sterling Transaction Fee – 2.75%

- Late & Failure Fee for paying Default Sum – £12 (For paying late or not paying at all)

- Over the limit of Default Sum Fee – £12 (For going over the Credit Limit)

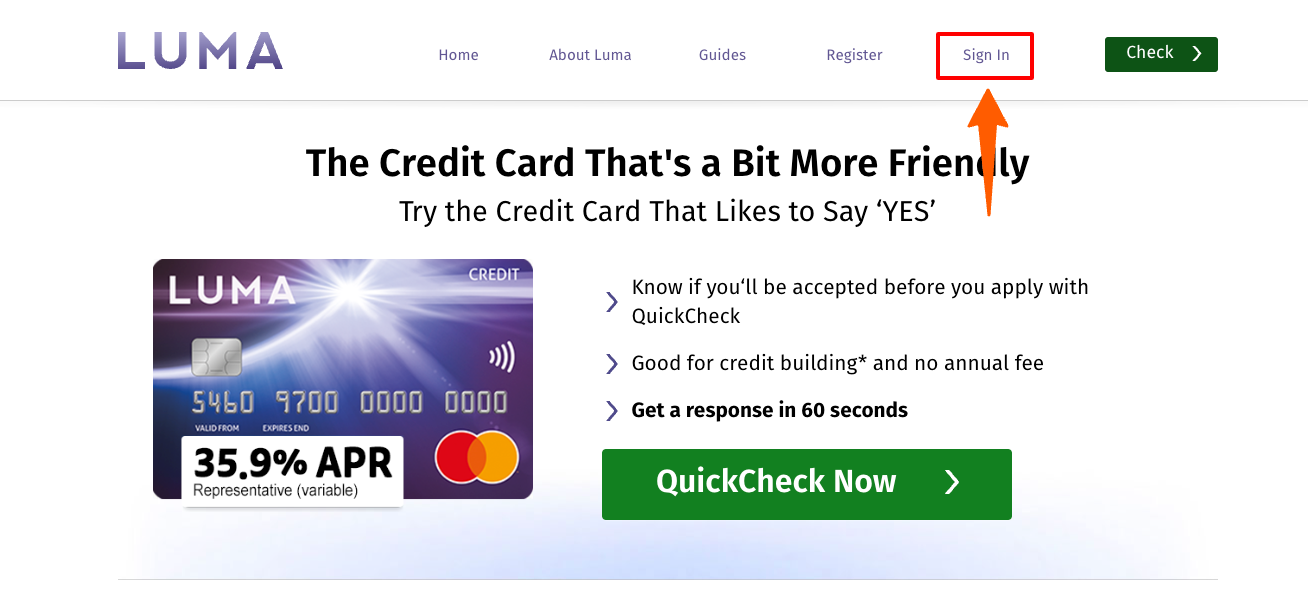

Access your Luma Credit Card Login Account

To get login or Sign In for the Luma Credit Card, go through the below instructions:

- Go to the authoritative website of the Luma Card, (UK).

- You can also tap on the link given www.luma.co.uk.

- On the home page of the website, you can easily find & tap on the “Sign In” tab on the navigation bar above.

- Now on the Capital One Sign In webpage, put down your “Username” & “Password” as needed.

- Then by pressing on the “SIGN IN” bar below, you can access your account.

How to Recover Luma Credit Card Login Credentials

If you want to Reset or Forgot your Password for the Luma Card, then you need to go to the Capital One Sign In webpage, by following the Sign In process above. Here you can find the “I’ve forgotten my password” option, now by tapping on the link you will be deferred to another page. Here you have to enter your “User Name” (this can be your Username), now tap on the “Continue” bar below and follow the on-screen prompts to finish.

Please Note: A simple rate of interest of 31.10% is charged for Purchases, Balance & Money Transfers, and Cash Withdrawals, from the date of this Agreement.

Contact Details

Capital One Card Services

P.O. Box 5283

Nottingham

NG2 9HD

If you want to send a Cheque Payment, Please Mail it to

Capital One Europe Plc,

PO Box 1517, NORTHAMPTON, NN1 9GZ.

Also Read

How to Access Aspen Family Portal Login Account

Find Health Plans for Agile Health Insurance