Application process for SoFi Loans Online – sofioffer.com

SoFi’s main goal is to assist individuals with arriving at monetary freedom to understand their aspirations. Furthermore, monetary freedom doesn’t simply mean being rich it implies arriving at a point where your cash works for the everyday routine you need to experience. All that they do is intended for assisting their individuals with getting their cash right.

SoFi’s center organization esteems are at the focal point of all that they do and genuinely reflect how we cooperate, serve their individuals, and construct their items. Social Finance, Inc is established by Stanford business college understudies initially utilizing a graduated class-supported loaning model to interface ongoing graduates with graduated class locally.

SoFi Offer Highlights:

- Earn from $5k to $100k at fixed rates that beginning at 5.49% APR

- No secret expenses or pre installment punishments

- Get a 0.125% rate rebate on an extra SoFi advance only for being a dedicated SoFi part

- Assuming the borrower misfortunes their work they might meet all requirements to have their regularly scheduled installment required to be postponed

- SoFi offers grant winning client assistance 7 days per week (yes they are open on Saturday and Sunday)

SoFi Offer Lowlights:

- Not accessible in the province of Nevada

- Your financial assessment is 650 or less (for the most part SoFi won’t loan to a FICO rating under 650)

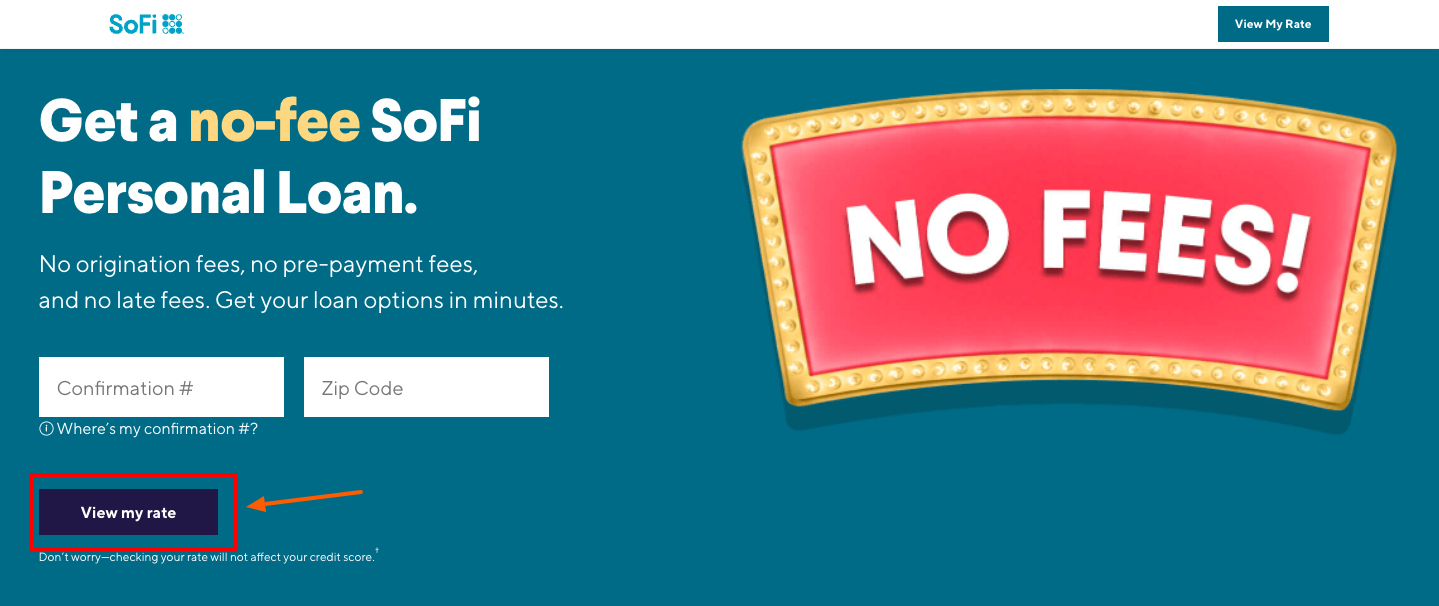

Apply for SoFi Fixed Rate Loans:

- To apply for the fixed rate loans go to the webpage sofioffer.com

- Next at the center left side of the page add the confirmation, zip code

- Click on ‘View my rate’ tab.

- To view your rate click on ‘View my rate’ tab from top right side of the page.

- Enter your name, state, email; check the box to agree to the terms.

- Now click on ‘View my rate’ button.

- If you want more information you have to login with the online account.

SoFi Login:

- Enter the URL sofi.com in the browser search box. Then hit enter.

- At top right side of the page click on ‘Log in’ button.

- Add the account associated email, password

- Now click on ‘Log in’ button.

- After logging in to the online account you can access the offer.

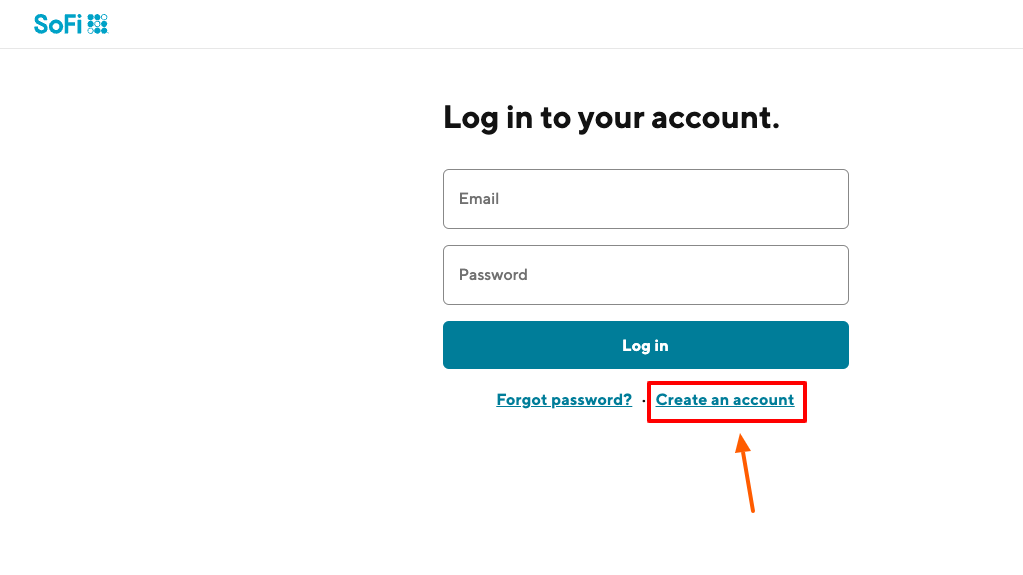

Reset SoFi Login Credentials:

- To reset the login details visit the webpage sofi.com/personalloan

- Now click on ‘Forgot password’ button under the login boxes.

- Enter account associated email click on ‘Reset password’ button.

- Follow the page instructions to complete the login recovery process.

Create SoFi Account:

- Visit the official webpage of the SoFi P2P Lending. The URL for the webpage is sofi.com/personalloan

- In the login section click on ‘Create an account’ button.

- Secondly provide your name, choose the state, email, password, agree to terms click on ‘Next’ button.

- Now follow the page instructions after this and complete the registration.

SoFi Bill Payment by Mail:

- You can pay the bill through mail. Send money order or check.

- Post it to: Personal Loans: SoFi Lending Corp. or an affiliate Personal Loans. PO Box 654158. Dallas, TX 75265-4158.

- Home Loans: SoFi Lending Corp. or an affiliate. P.O. Box 11733. Newark, NJ 07101-4733.

- SoFi Lending Corp. or an affiliate: P.O. Box 54040. Los Angeles, CA 90054-0040

- Student Loans: MOHELA. P.O. Box 1022. Chesterfield, MO 63006-1022.

Also Read:

Access to Wells Fargo Checks Login

How to Access Ford Credit Account

Access To Your Citi Bank Online Account

Frequently Asked Questions on SoFi Fixed Rate Loans:

- Is SoFi Com Legitimate?

SoFi is a protected bank for those with a nice record of loan repayment who are searching for lower APRs than other web-based contenders. Indeed, even while offering credit sums as high as 0,000, you will not at any point get hit with a solitary charge.

- Does SoFi Hurt Your Credit?

To check the rates and terms you might fit the bill for, SoFi conducts a delicate credit pull that won’t influence your FICO rating. A hard credit pull, which might affect your FICO rating, is required assuming that you apply for a SoFi item subsequent to being pre-qualified.

- What Credit Score Do You Need For A SoFi Loan?

Great to fantastic credit, for an individual advance, SoFi advance borrowers should have a FICO score of something like 680. Short record of loan repayment, SoFi is keener on how dependable you’ve been at taking care of bills.

SoFi Contact Information:

For more help options call on (855) 456-(7634).

Reference Link: